What follows is a "quick and dirty" real world model to help you understand the relative efficiency of the SaaS Business Model vs. traditional sales models.

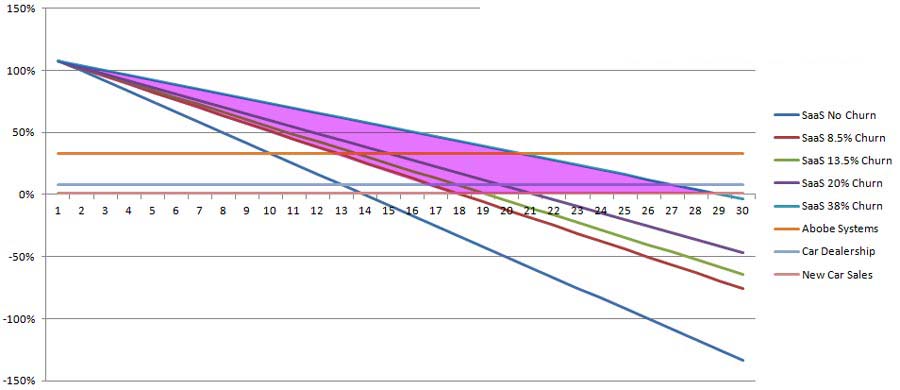

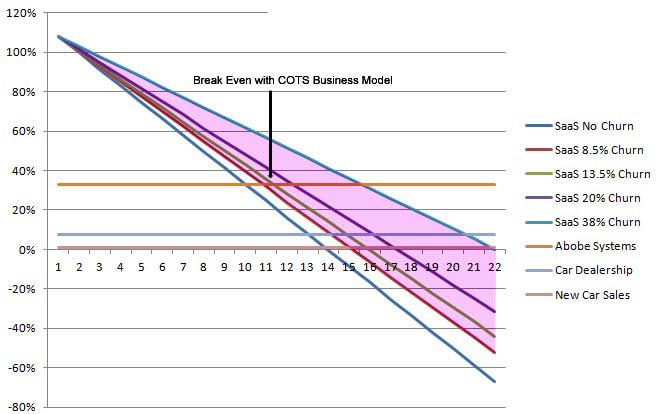

The model works independent of price utilising a spread of industry averages for the Cost of Customer Acquisition (i.e. CPC>Visitor >Trial>Customer) & Churn Rates (B2B and B2C) to illustrate the break even point between SaaS and "old school" traditional software licencing (COTS) models and the Cost of Customer Acquisition for a New Car Dealership.

The key difference between SaaS and the other models is when you buy COTS or a new car the cost of goods (including the costs associated with customer acquisition) are paid in full on delivery. With the SaaS model these costs are annualized as part of the Customer Lifetime Value calculation.

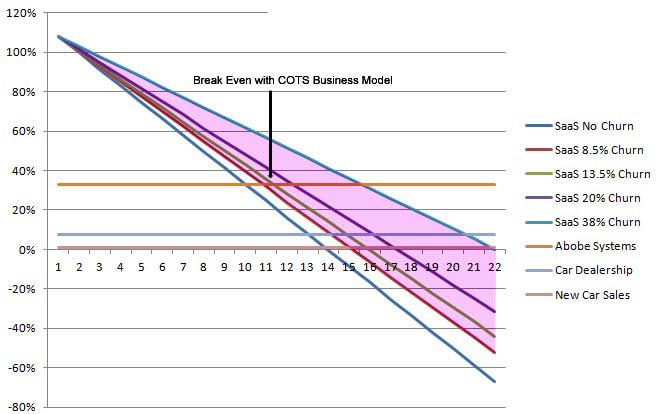

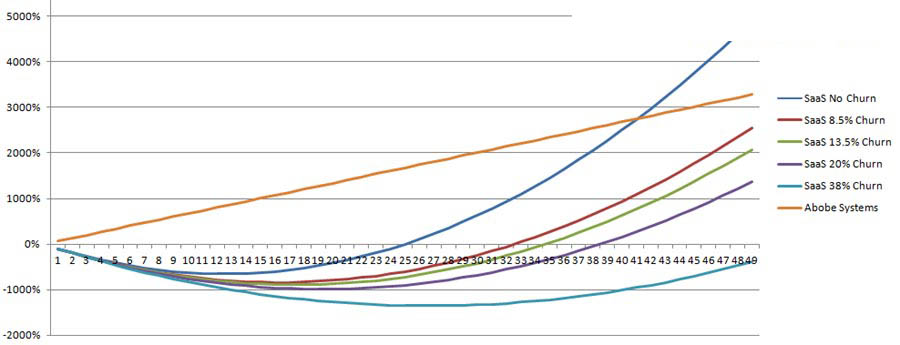

The question then becomes one of how long does it take for SaaS to breakeven with the traditional COTS sales model (e.g. Adobe Systems)?

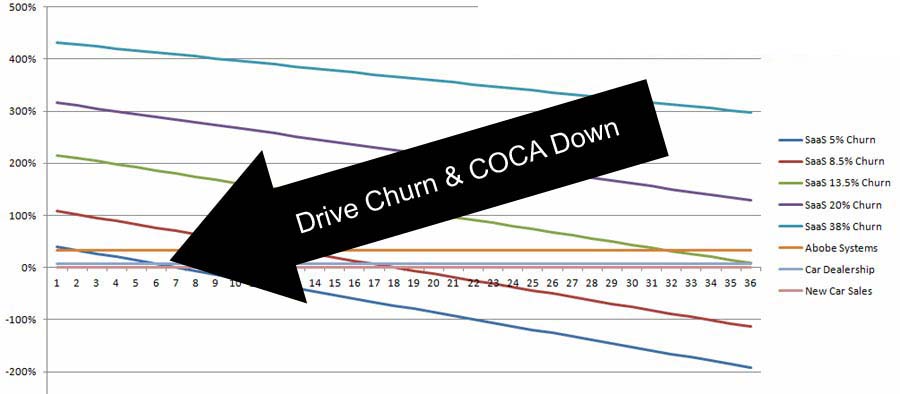

This first chart illustrates the average SaaS operation will breakeven on the Cost of Customer Acquisition with the Traditional COTS in 12 months. 18 Months with the New Car Dealership.

The means the average SaaS provider is funding the customer's usage of the product for the first 12 months, excluding operating & delivery costs, before the provider breaks even with the COTS vendor on the Cost of Customer Acquisition. High churn vendors will be waiting upwards of 2 years.

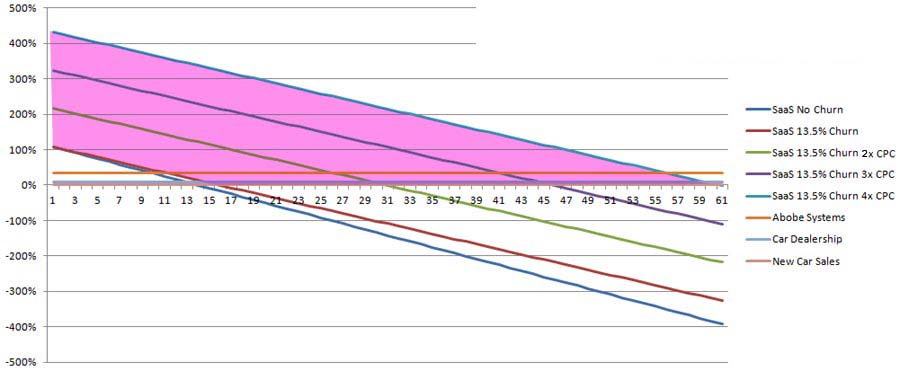

If the SaaS Provider chooses to increase their advertising and marketing spend they will discover the increase in the cost of customer acquisition will result in a delay on achieving break even ROI on the cost of customer acquisition.

Disruption comes at a premium and new entrants will be in the business of burning more cash than the incumbents to acquire market share. The strategic objective being to drive COCA and Churn rates down to acceptable levels within the first 3 years of operations.

This challenge is amplified when you factor in the R&D (i.e. Continuous process improvement) required to offset the impact of new entrants into the churn mix.

The ongoing cost of funding R&D adds 90 days to the established providers breakeven point and years to the new entrant.

But this is only the beginning of the journey when it comes to understanding the strengths and weaknesses of the SaaS Business Model. If we are to understand the depth of the challenge facing SaaS start-ups we need to go back to the beginning of journey.

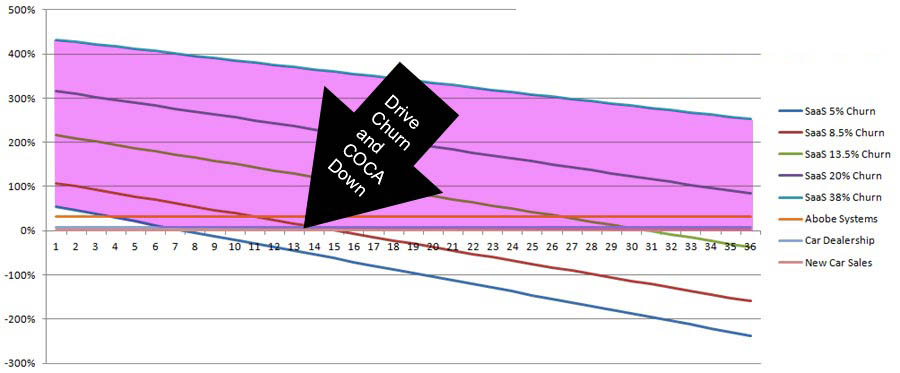

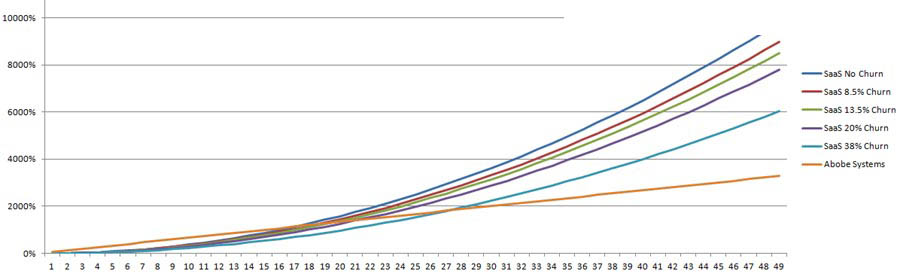

At first glance the model suggests that a SaaS start-up operating at optimal performance can out perform the traditional COTS business model after two years of operations.

This would be true if we are talking about just selling the product to one customer. The challenge becomes a little more complicated once you expand the model to accommodate sales to additional customers over time.

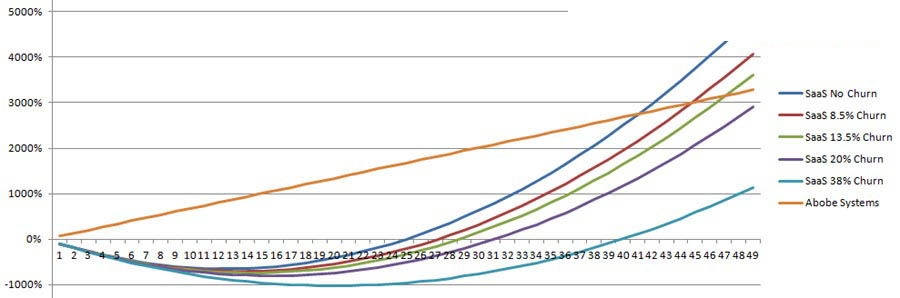

This simple model illustrates the gap in performance between SaaS and COTS if one assume linear growth (i.e. The same number of customers are added to the model each month as was the case in the first month).

As you can see breakeven becomes a question of years rather than months - and this is before you factor in the cost of providing the freemium trial for each customer to try before they buy.

The difference is each new product sale via the COTS model brings in new revenue to fund growth and R&D. Meanwhile, by annualizing the cost of customer acquisition, each new SaaS customer actually increases the cost of doing business.

Add to this the costs associated with funding the R&D required to minimise the churn created by new entrants and you discover that even the SaaS business model operating at optimal performance becomes something of a money pit. Rather than providing a "low cost of entry" for a new generation of disruptive software developers it requires deep pockets to fund growth. The reason being, as with all networked business models, discovery across the network is the most expensive part of the equation.

Building just another billboard, book shop or spreadsheet in the desert is the easy part. The challenge is sharing that experience with others, and that, alas, more often than not, means having deep pockets.