Originally Published Spring 2018.

In 2017 Tymbals was invited by Accenture to participate in the APAC FinTech Lab.

To demonstrate the potential of AI to revolutionise the investment banking sector we spent a week building a Robo Venture Capitalist.

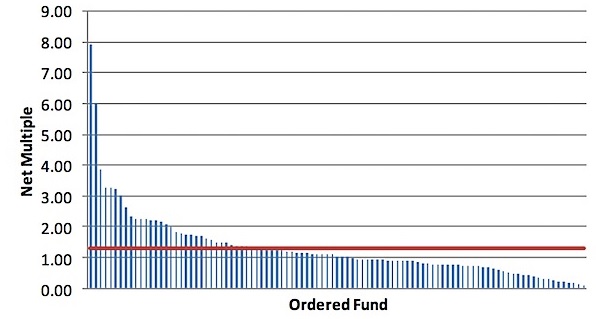

The venture capital market has something of a reputation for being an underperforming asset class.

But an emerging generation of Artifical Intelligent VC's leveraging big data sets have proven capable of picking winners from groups of start-ups that have achieved C+ Rounds funding.

Could we build a Tymbals model capable of picking the winners at A, B or even Seed level?

Again the market data was thin and noisy.

But within days we had modelled the answer.

A bayesian probability engine that models Emergence & Market Contagion to predict Start-Up success.

All wrapped up in a mobile app.

A veritible VC in your pocket

But before we let you play with the model let's spend some time understanding the challenge.

Most Venture Capital Fund Mangers play the game by the rule book.

But then again most Fund Managers don’t play the game very well. Most funds fail to beat the stock market index.

This means teaching the machine to lose is easy. The market is awash with data on how to pick a loser. The challenge is teaching it to pick winners... Big winners. Early!

So how do we do that?

Clearly Venture Capital is a game of exceptions rather than rules. Break the rules. Invest in the exceptions that deliver 10x, 20x or even 50x growth and you will build a portfolio that beats the industry average and meets investor expectations.

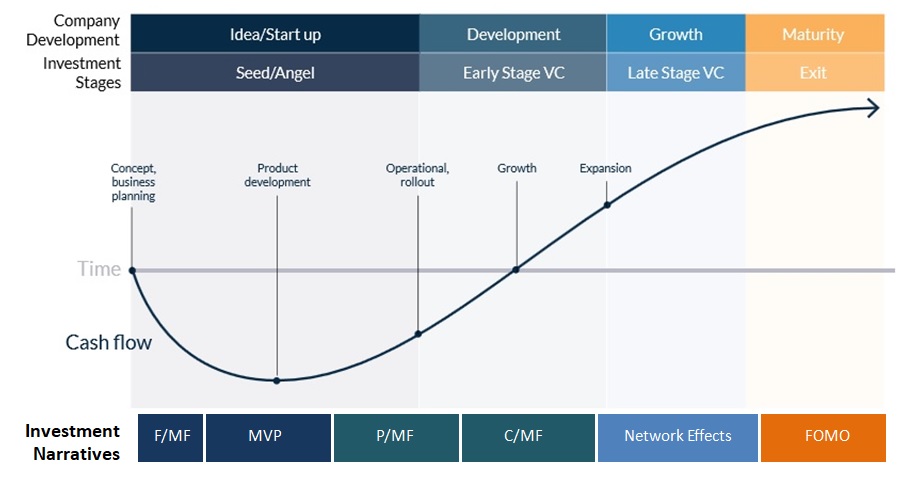

So let’s begin our journey by deconstructing the Venture Capital Rule Book. What are the popular investment narratives that consistently deliver poor investment results?

It begins – like most American Stories - with the hero’s journey.

At the Seed Stage there is Founder/Market Fit (F/MF): The idea that measuring the correlation between the founders’ experience and the target market will provide an accurate forecast on the probability of success. The VC mantra being: “Invest in people. Not ideas.” & “By the way there is no I in Team - but you will find me!”. Great Team = Great Product. The equation is self evident.

The next stage of investment is the Minimum Viable Product (MVP). We invest to discover if we have a working model. We conduct user trials to identify the Product/Market Fit (P/MF) – i.e. does it work and does it address a need?

Then we invest in quantifying Customer/Market Fit (i.e. who is buying? & how are they buying - e.g. Sales Channels). Calculating the Maximum Addressable Market and forecasting CoCA/ARPU/LTCV.

The growth stage funding is about identifying the social proof that will unlock the "Network Effects" that drive growth.

The final stage is about readying the market for the “Pump and Dump” that allows the invested capital to be released back to the fund and its investors.

Copious amounts of commentary exist on how to apply these rules and formulas to the business of forecasting start-ups success. The question is: Is there a contrarian position to these narratives?

Let’s begin with the idea of Founder/Market Fit. For the contrarian thinker the logical question may be: Who is more likely to come up with a better (Think: "Game Changing") banking product or service solution? Somebody working in a bank or a customer who is so annoyed and angry with the service they decide to build their own bank?

The logical answer is the founder who works in the bank would bring more experience to the challenge. But the disruptive game changer may well be the angry customer who has the drive, passion and insight to build the exception – a totally new way of banking and/or investing.

If we remap the start-up journey from the disgruntled customer’s perspective we discover the early stage cycle is reversed. It becomes the customer’s journey: re-imagined.

The Customer Market Fit is (pre)established. The only question is how many other bank customers feel like our ‘Founder’. How many are motivated to try something new? If the answer is lots then the MVP fills the void – The customer’s desire for change. Product Market Fit is established. Meanwhile the start-up team is displaced by the rapid transition to a business system capable of delivering and supporting the new way of doing business.

The founder – rather than being the innovation hero - is simply the company’s worst customer.

Rather than trying to solve the imagined problem the company is busy working to solve the founder’s problem... which turns out to be everybody’s problem.

The social proof also becomes self evident: My problem is (y)our problem. My solution is (y)our solution ...

The early stage investment model is pivoted from investing in a solution looking for a problem (& a market) to investing in a problem (& a market) looking for a solution.

Which raises the question: Are exceptional investments more likely to be started by outsiders rather than insiders?

Recent history suggests both yes & no. For example none of the founders of Google, Facebook, SnapChat, YouTube or Yahoo! came from advertising or publishing backgrounds and the founder of Amazon was in Financial Services before deciding to build an online book store. The same principle applies to the founders of Paypal, Uber, AirBnB, Zynga, Zenefits and Alibaba.

Meanwhile eTrade, Netflix, Salesforce, Instagram, Twitter, WhatsApp, Android, Xero, DataRobot, Dropbox, Market, Splunk, Slack, Lyft and eBay have founders with prior exposure to the markets and business models they have distrupted.

So the answer is more problematic than the popular VC roadmap and metrics suggest.

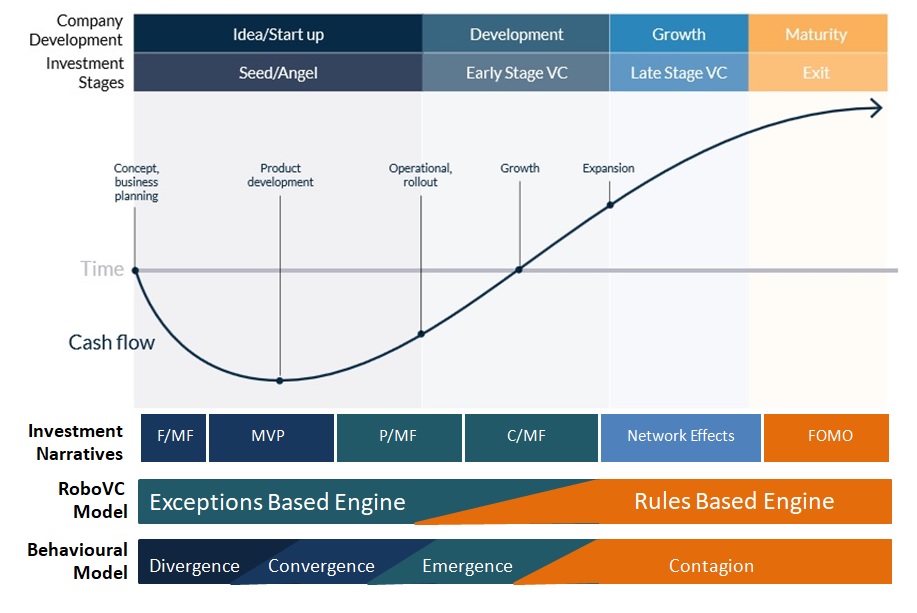

What we developed in Hong Kong was a multivariant approach to training an AI powered RoboVC Investor.

The model below is the framework for a rudamentary Behavioural Model that explores the probability of the venture capital community making an investment in a start-up

It feeds mainstream Angel & Seed (Pre-Money Investment)'rules of thumb' into a simple bayesian model.

The traditional VC Investment Model can be summarised as V=P*S*M - (Where V= Valuation, P = Scale of the Problem, S = Scale of the Solution and E = the experience of the founders)

We can expand on that formula by adding elements of MVP, FMP, CMP and MAM into the model

For example: